Pakistani remittance inflows remain stable for the month of Jan.

Pakistan has been lucky that overseas Pakistanis are helping them to avoid taking expensive external loans. Pakistan friendly countries are unwilling to lend Pakistan external financial support to meet IMF external financing targets. In the past, Pakistan's friendly countries, like the UAE, KSA, and China, helped Pakistan to meet its external financing targets without any strings attached. However, those days are gone now, and even small loans from these countries have so many conditions that Pakistan avoids taking loans from them, and they go towards international commercial bank loans.

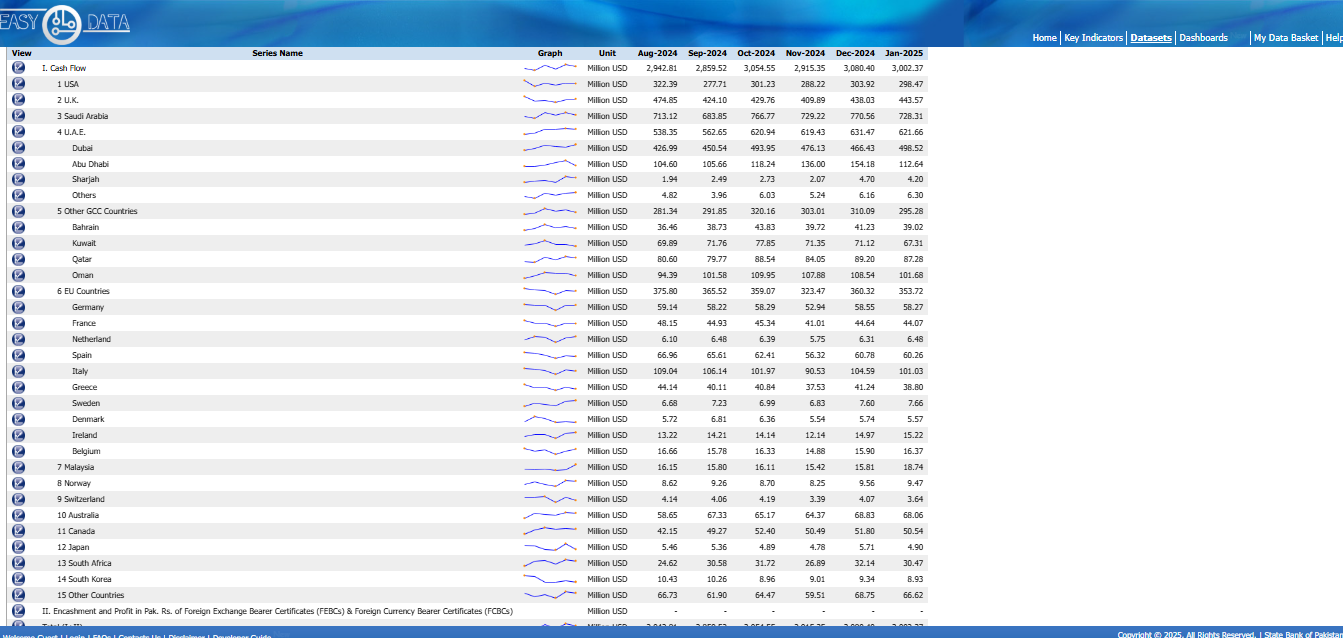

Remittance inflows for the month of January were US 3 billion dollars and 3% lower compared to December 2024. In 2024, Pakistan's remittances were around US 2.4 billion compared to the same month last year, and there was around a 24% increase in remittance inflows compared to January 2024.

Remittance inflows exceeded US$3 billion in the month of January, and that shows that reforms regarding remittance inflows and overseas contributions are paying off. Pakistan had no other choice but to cut imports and go towards a current account surplus. Otherwise, Pakistan would have faced a disaster, and no one was going to lend Pakistan external loans to cover up its current account deficit. Moreover, remittance inflows not only increased, but they are also the major reason behind Pakistan's external current account surplus, and it has made it easy for Pakistan to meet IMF conditions regarding external financing.

The IMF projected that Pakistan would be facing a current account deficit of around US 4 to 5 billion dollars at the end of fiscal year 2025; however, that is not going to happen now according to the IMF, because Pakistan made a remarkable turnaround with a current account surplus of US 1.21 billion dollars, and even the IMF has appreciated the achievement by Pakistan. Pakistan's inflows are the world's top 10 ranking. Remittance inflow increases are due to Pakistan making reforms regarding foreign exchange in 2023, implementing FATF-based reforms, and IMF AML reforms, which helped Pakistan to increase inflows of remittance via banking channels.

The State Bank of Pakistan and the Government of Pakistan give incentives to increase the inflows of remittances via banking channels, and these incentives are given to commercial banks to increase the remittance inflows. It is expected that remittance inflows for the months of February and March are going to increase further due to Ramadan and EID.