ECs managed to ease off about US 7 billion dollars for SBP.

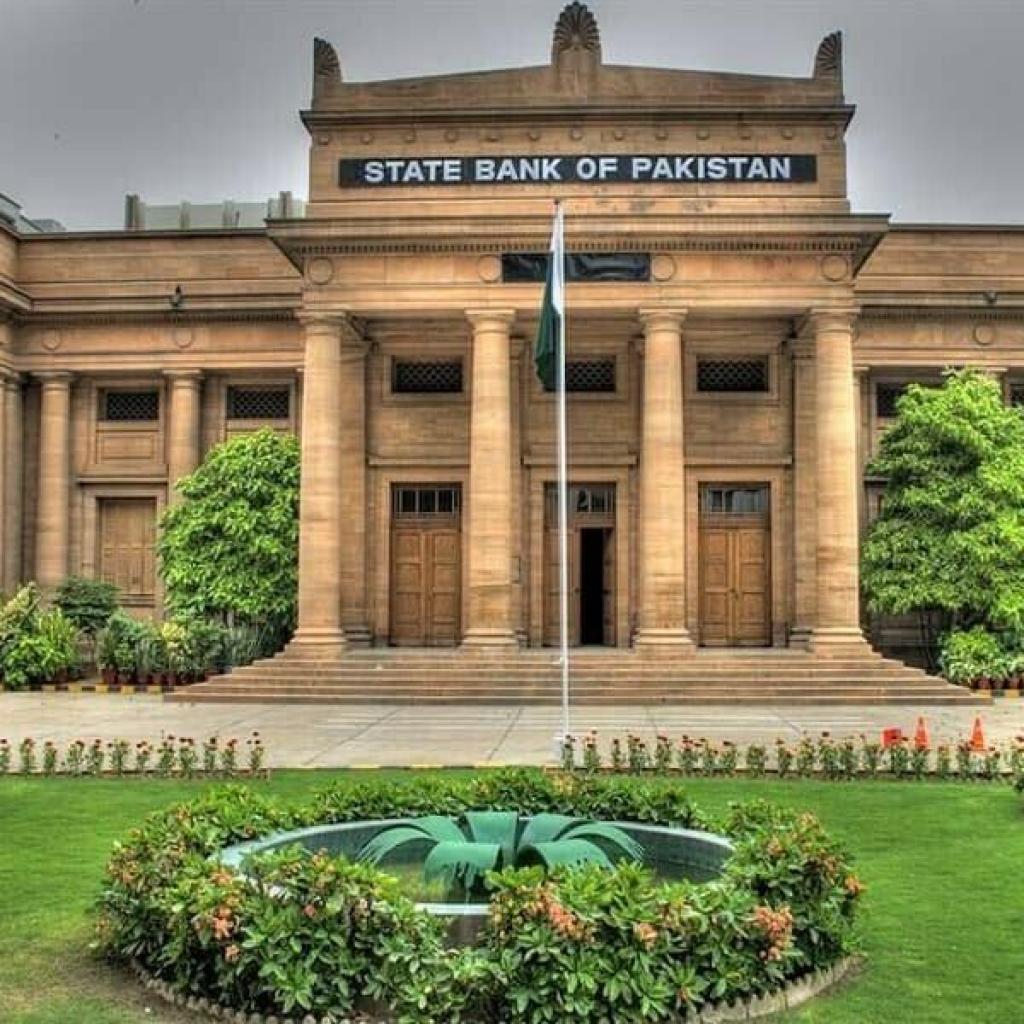

Exchange companies in Pakistan managed to handle about US $7 billion for Pakistan. The ECAP (Exchange Companies Association of Pakistan) chairperson said that they had provided US$3.85 billion to SBP (State Bank of Pakistan) to help them manage inflows, build reserves, and manage exchange rates, and the remaining US$3.15 billion was being used for people who are going for international travel, Hajj, and Umrah pilgrimages.

The finance minister also said that no country now would give us unconditional lending, so we have to manage mostly by ourselves, and any lending by countries would be conditional based on regional changes, Pakistan not being willing to do reforms, and exceeding the threshold. Moreover, now Pakistan is managing dollar inflows by using its own resources.

The ECAP Chairperson also said that his association plays a major role in Pakistan’s economy because they help SBP to pay off external loans and manage exchange to remain at a current level. Otherwise, there will be frequent fluctuations in the PKR against the USD. They hope that they will arrange more dollars this year as well so that SBP does not require extra external funding.